Table of Content

There are 433 active homes for sale in Martinsburg, WV, which spend an average of 46 days on the market. Some of the hottest neighborhoods near Martinsburg, WV are Downtown Martinsburg, West End, South End, Historic City Park, Elgin Station. The map below shows different options; parking at the train station will be free for the weekend and there are several city parking lots within blocks of the Roundhouse that will also be free for the weekend. Leave a memory or share a photo or video below to show your support.

Berkeley County has a vibrant culture and full events calendar. Whether you’re looking to celebrate the apple harvest, the arts, food, farming and railroad heritage, or experience a traditional county fair our community’s events can cover all your interests. Come enjoy the 6th Annual Christmas Open House at Blue Goose Pottery’s only winter event! Enjoy a cozy, relaxed setting at Blue Goose's home studio while you leisurely browse for a unique pottery gift or a must-have for yourself. The West Virginia Home Show is a one-of-a-kind opportunity to engage your target audience.

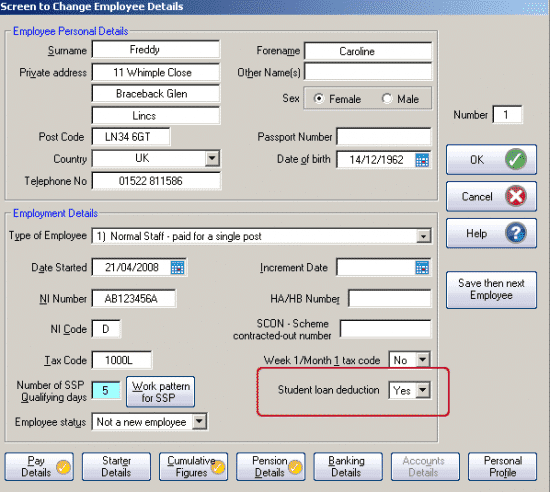

How to buy a home in Martinsburg, WV

We could not have asked for a better business opportunity for customers and networking opportunities with other vendors. The event will include an art walk, live music, and more. Homes for sale in Martinsburg, WV have a median listing home price of $279,900.

Not only do we meet with hundreds of potential homebuyers and families who use our services, we get the chance to interact with organizations from across the housing industry. It’s a fantastic weekend and we look forward to it every year. With over 1,900 locations, Dignity Memorial providers proudly serve over 375,000 families a year. The Berkeley County Youth Fair is one of the few remaining Fairs dedicated to Youth exhibitors. The exhibits at our Fair are representing 4-H, FFA, FCCLA, Boy Scouts, Girl Scouts, and the Boys and Girls Club in Berkeley County. The Fair will begin in the late summer of each year with the Miss Youth Fair contest.

Get to the heart of it. Discover, explore, and experience Berkeley County.

We will have events, entertainment, livestock competitions, and carnival rides for over a week, concluding on Saturday. This FREE event is on the lawn at Blue Goose Pottery with plenty of parking. The more than 40 leads we received from the Show will continue to keep us busy the remainder of the year. The marketing efforts, quality, and professionalism of the staff of the WV Home Show exceeded our expectations. Our single booth was over crowded with customers and we expanded to 2 booths in 2016 and we will expand to 3 booths this year.

Send Flowers Send flowers or a gift to a service or family's home. Come experience Christmas as the Berkeley County Museum at the Belle Boyd House on December 3rd from pm. Take a tour of the exhibits and view all the holiday decorations.

North Central WV Home Builders Association – Home Show

Making a left on West Stephen Street on to Route 9, passing through Martinsburg City Square , ending and disbursing with a right onto East Race Street and parking lot area. This is event is designed for small children and families to experience the festivities of New Year's Eve without staying up until midnight. Companies and organizations will sponsor and support the event. The Eastern Panhandle Home Show will have everything you need to start your new home projects!

Nearby grocery stores include Sheetz, Sheetz, and Aldi. Nearby food & drink options include Mountaineer Grill And Pub, Kitzie's of Spring Mills, and Sky Room Lounge. Parks near 202 Magellan Dr include Mc Mahon's Mill Recreation, Yankauer Nature Preserve, and Falling Waters Campsite. Mountaineer Meat Smokers and Heavenly Taters Confections will be here with their food trucks. The Martinsburg Veterans Day Parade will start at 1 p.m.

Eastern Panhandle Home Show 2023

Main Street Martinsburg is proud to present the annual Martinsburg Christmas Parade on December 6th at 7pm in downtown Martinsburg, WV. Bring the whole family out to downtown to watch this night parade. Ebenezer Scrooge, is a wrenching, grasping, scraping, clutching, old miser. The spectres take an unwilling Scrooge on a journey through time where he is forced to see the error of his ways and comes to appreciate his fellow man and revel in the joy of Christmas. Find a contractor, supplier, or other professional in the building industry or an opportunity to help your business grow.

Your home is one of, if not the, largest investments of your life. Making decisions about products, services and businesses for your home can be tough. The Home Show makes it easy to meet and talk to many vendors in one place, get new ideas and see products in-person.

Gain inspiration and ideas from vendors, exhibits and displays. There will be plenty of parking on site for the Home Show, located at 100 East Liberty St.

Exhibitors are expected to display their products and services. Home Show is going to be organised at Berkeley Plaza Theater 7, Martinsburg, USA on 24 Mar 2018. This event forays into categories like Home & Office, Furnishings & Decor. Popular points of interest near 202 Magellan Dr include Mountaineer Grill And Pub, Kitzie's of Spring Mills, and Sky Room Lounge.